PAG News

You can also keep up to date with news from PAG by subscribing to our Email Group. (To join, just send a blank email to

Pensionstheft+subscribe@groups.io).

* * * * * * * * * * * * * * *

Budget indexation announcement

27 November 2025

In a surprise move in her budget speech yesterday, Chancellor Rachel Reeves announced that PPF and FAS members, who have pre-1997 contributions and whose schemes provided indexation, would receive indexation in future in line with CPI capped at 2.5% based on their current payments. Here is what she said:

"Having heard representations from my hon. Friends the Members for Banbury (Sean Woodcock) and for Edinburgh South West (Dr Arthur), I will index for inflation on pensions accrued before 1997 in the pension protection fund and the financial assurance scheme, so that people whose pension schemes became insolvent—no fault of their own—no longer lose out as a result of inflation.

There is a fuller account of the changes on the PPF website here.

This is excellent news as up until now there has been no indexation at all for those contributions. We would like to thank Mrs Reeves and Pensions Minister Torsten Bell for their concern and for the effort involved in arriving at this measure.

But, since PAG speak for members of the FAS, it is discouraging to note that this measure, welcome as it is, is disproportionately weighted towards members of the PPF. This is because FAS members (whose schemes entered windup prior to 2005) are on average rather older than PPF members and will have been retired for longer. So they will enjoy the benefit of indexation for fewer years and, because the indexation applies to their payments now rather than their original payments in today’s money, the indexation will apply to only a fraction of their original entitlement - less than half in the case of someone who retired in 2000, calculated according the change in CPI.

More details will emerge over the coming days and we will be keeping members posted about developments on our dedicated email group (details here).

* * * * * * * * * * * * * * *

Substantial media coverage of PAG evidence session

5 October 2025

Since Terry Monk and Roger Sainsbury presented evidence to the parliamentary scrutiny committee (see next item below) there have been a number of thoughtful articles published in the media. In particular, Henry Tapper, a well-respected pensions blogger has posted two articles here and here and, more recently, Pensions Expert have produced an in-depth report on the issues raised. Terry summed it up best in his evidence, when he said "This Minister has met us, and he knows the issues, but we do not know what is in the mind of the DWP or the Treasury in dealing with this issue. Once we know that, we will know whether we are fighting or we are working together, and what the answer will be."

* * * * * * * * * * * * * * *

PAG and DPA give evidence to Parliamentary Committee

2 September 2025

Terry Monk from PAG and Roger Sainsbury from the Deprived Pensioners Association today presented the case for implementing indexation in respect of pre-1997 contributions for both the FAS and the PPF to the committee which is evaluating the 2025/26 Pensions Bill. Both of them made the case for righting this injustice in lucid and forthright exchanges. You can watch the session on Parliament TV or read the transcript here (starting at 4:45).

* * * * * * * * * * * * * * *

PAG to give evidence to Parliamentary Committee

29 August 2025

Representatives of PAG have been invited to give evidence to the Public Bills Committee in Parliament as part of its consultations on the 2024/25 Pensions Bill. The session will be on 2 September and will be a good opportunity for our voice to be heard at a time when changes to the bill can still be made. It is becoming clearer and clearer that the failure to provide any protection against inflation for the FAS payments is causing more and more hardship and we will make that point forcefully.

* * * * * * * * * * * * * * *

Great coverage in the pensions press

26 August 2025

Following our press release (see below) we have had two excellent articles which have appeared in the two main magazines for pensions professionals: Professional Pensions and Pensions Age. Our thanks to Jonathan Stapleton and Sophie Smith for their support.

* * * * * * * * * * * * * * *

We are dying for our pensions

25 August 2025

Next week the Public Bills Committee in Parliament will start consideration of the 2024/25 Pensions Bill. One part of the bill which the committee will examine deals with the payments from the FAS and PPF. The lack of indexation of these payments has been the major source of losses for most members, even though we paid for them, but the bill doesn't currently include any provision for improvement. A number of MPs and members of the Lords are planning to introduce an amendment to address this. We need as many MPs as possible to support the amendment and urge you to write to your MP to encourage them to join in. PAG have produced a press release which gives all the details, which you can download here and which you can send to them.

* * * * * * * * * * * * * * *

A new government, a new campaign

14 July 2024

As our new government settle into their roles and get themselves sorted out, PAG are also gearing up to present our case to them. We had a good relationship with the previous pensions minister (Paul Maynard) who was genuinely trying to help us, especially in the light of the recent report of the Work and Pensions Select committee and we hope to establish a similar relationship with the new ministers.

* * * * * * * * * * * * * * *

The Work and Pensions Select Committee report published today

26 March 2024

Following a consultation at which PAG gave verbal evidence, the committee's report on defined benefit pensions was published today. The committee were firmly of the view that FAS benefits should be brought into line with the PPF. They wrote (section 161):

"Financial Assistance Scheme (FAS) members are likely to have more of their

service before 1997, so are particularly likely to be affected by non-indexation of

pre-1997 benefits. Any improvements for PPF members should also apply to FAS

members. Given the age of many FAS members, the Government should legislate as

a matter of urgency to provide indexation on FAS compensation for pre-1997 rights,

where their schemes provided for this, funded by the taxpayer. The Government should

review the Financial Assistance Scheme, including looking at the case for removing

other discrepancies in FAS compensation, compared to the PPF, such as the continued

application of the compensation cap and lack of interest on arrears."

The report can be viewed here.

* * * * * * * * * * * * * * *

PAG meet with the Minister for Pensions

8 January 2024

A delegation from PAG met with the Parliamentary Under-Secretary of State for Pensions Paul Maynard today (following a request from the WPSC) for a discussion about the FAS and how it can be improved. Whilst the content of the meeting is confidential, he listened carefully to the case we put to him, which emphasised the hardship being caused by the lack of indexation in respect of pre-1997 contributions.

The following day, Mr Maynard gave oral evidence to the Work and Pensions Select Committee in which he said:

"I spent a lot of my Christmas mulling over the issue. We had a meeting with officials before I met the group, where I commissioned quite an extensive piece of work. I then met them and listened very carefully to them. I know there are two of them sitting behind me now—their eyes are boring into the back of my head, I have no doubt. I was very clear with them then that I was very much listening—and reflecting, not just listening—and that I will be having further meetings with officials when the work I have commissioned comes back to me.

What I want to stress to the Committee today is that I do not think, “You wrote to me to say, ‘Have a meeting’; I had a meeting; that is the end of it all, and we can all move on—wonderful.” There is a process now going on where I am reflecting on and discerning what I have heard, and we will see where that gets us. I do not want the Committee to think, “Great, there is going some be some magnificent change occurring”—I have made that clear to the people I met as well—but there is a body of work now taking place to help me make further decisions. That is as much as I can say at this stage."

The full transcript of the evidence session is available here.

* * * * * * * * * * * * * * *

Work and Pensions Select Committee hear from PAG

7 November 2023

The WPSC is currently running an enquiry into the operation of defined-benefit pension schemes and invited PAG to submit evidence relative to the operation of the FAS. After reading our written submissions, they invited us to answer questions in person, so Terry Monk and Richard Nichol went to Westminster to represent us. They gave solid answers to the MP's questions and were able to make the case persuasively for the provision of indexation in respect of pre-1997 contributions. You can see a video of the session here, and read a transcript here.

* * * * * * * * * * * * * * *

A new campaigning group - the Deprived Pensioners Association

5 May 2023

A group of PPF members have got together to form the DPA with the aim of taking the government to court to force implementation of payment indexation for pensioners with pre-1997 contributions in both the PPF and FAS. (At the moment, only payments resulting from post-1997 contributions are indexed.) The group is led by several ex-directors of the Mowlem engineering group and it is seeking contributions to its fighting fund.

Further information can be found on their website.

* * * * * * * * * * * * * * *

PAG members hold demonstration outside the Welsh Sennedd in Cardiff

22 March 2022

A large number of former ASW workers, as well as other Pension Action Group members, stood in protest outside the Welsh Senedd Parliament building in Cardiff yesterday, Tuesday 22nd March, to show their continued anger at not receiving the pensions that they had paid for over their working lives.

These former workers are clearly not giving up the fight, and in Cardiff they stood defiantly in front of their iconic 'Stripped of Our Pensions' banner which has been the hallmark of their campaign since it was first unfurled over twenty years ago. Many Welsh Assembly members came out to support the campaigners and have vowed to write to the Minister, the Opposition shadow pensions ministers and Welsh MPs to demand action be taken to heal this long running sore.

A copy of the press release is available here.

* * * * * * * * * * * * * * *

PPF publishes plans for implementing Hampshire judgments

20 September 2021

The PPF have now published their plans for dealing with the judgments arising from the Hampshire judicial review and appeal, for both the PPF and FAS schemes. For the FAS, the cap will remain in place but the 50% minimum pension will apply (including the effect of the cap). Back payments will be made for both schemes to those affected, but FAS members are awaiting a DWP decision on whether a 6-year time limit for arrears will be applied. Arrears for PPF members will be paid with interest, but no interest will be paid for FAS members, and FAS members from solvent schemes will receive no benefit at all from the Hampshire judgments. Full details are available from this news item on the PPF website and there is an updated FAQ page for FAS members here.

* * * * * * * * * * * * * * *

DWP decide not to appeal the Hampshire appeal judgement

22 July 2021

The Department for Work and Pensions have let it be known that they will not be appealing the judgement of the Appeal Court that the cap on PPF assistance has to be removed. This should therefore mark the final stage of the legal process, at least as far as the PPF cap is concerned. The PPF website has a page which explains the implications of the decision for PPF members in practical terms here. There is a similar, though rather less encouraging page for FAS members here.

* * * * * * * * * * * * * * *

Hampshire appeal judgement handed down

19 July 2021

The judgement was handed down today for the appeals by the DWP and PPF against the judgement given in the judicial review of the implementation of the Hampshire judgement. In plain English, the Hampshire judgement established that every individual member is entitled to at least 50% of his pension entitlement from the pension scheme of an insolvent company. The judicial review was brought because many individuals were unhappy with the way in which the DWP were planning to implement the judgement, and particularly about the retention of the cap for those with large pension entitlements. The judges today ruled that the cap was unlawful, but that the PPF were legally entitled to use their preferred method of calculating the 50% minimum entitlement and their treatment of survivors' benefits. Note that this judgement relates to the PPF scheme. It is not yet clear to what extent it will be carried over to the FAS.

Links to the judgement and various summaries may be found on our Documents page.

* * * * * * * * * * * * * * *

Hampshire appeal starts next week

2 May 2021

The long awaited appeal in the Hampshire case (see below) is scheduled to start next Tuesday (4 May) and is expected to last for four days. The appeal, being brought by the Department for Work and Pensions and the Pension Protection Fund, centres around the approach to be taken in ensuring that members receive 50% of their entitlement; how survivors benefits should be handled; and on the legality of the compensation cap.

The hearing will start at 10:30am each day on Tuesday, Thursday and Friday, and will finish at 4:15pm. On Wednesday it will start at 10:00am and finish at 3:45pm. The hearing can be followed virtually by using one of the following links (different each day):

- Link for Friday 7 May - Click here

- Join with a video conferencing device 494469532@t.plcm.vc Video Conference ID: 128 670 614 6

- Call in by phone (audio only): +44 20 3443 8791,,357824064# Phone conference ID: 357 824 064#

IMPORTANT: If you wish to watch the proceedings you must have:

- Your camera switched off

- Your microphone switched off

There have been repeated interruptions on previous days because of attendees failing to do this and the court clerk has warned that, if this continues, the judges may decide to clear the court so that only the main participants are present. If you cannot guarantee that your microphone and camera are switched off, please do not try to attend as you risk having everyone else excluded, not just yourself.

Links to summaries of the issues may be found on the legal section of our Documents page.

* * * * * * * * * * * * * * *

PPF and DWP request leave to appeal

19 August 2020

In a last throw of the dice, both the DWP and the PPF have lodged applications for leave to appeal directly with the Appeal Court. If they are successful, then the appeal itself will take place later in the year. Both parties have requested an early hearing.

Links to summaries may be found on our Documents page.

* * * * * * * * * * * * * * *

Judicial review appeal hearing

31 July 2020

After the judgement on the judicial review (below) both the PPF and the DWP lodged applications for leave to appeal. The hearing on those took place today and the judge refused both applications, on all counts. He also heard arguments regarding the allocation of costs. The PPF and DWP now have to decide whether to make an application for leave to appeal directly to the Appeal Court.

* * * * * * * * * * * * * * *

Judgement released on Hampshire judicial review

22 June 2020

The judgement for the judicial review described below was handed down today and is a clear victory for the claimants that will have a substantial impact on the pension compensation that they will receive. They took an enormous financial risk in bringing this action so the result is richly deserved. Because the judgement is ruled by the EU Insolvency Directive (incorporated into UK law) it will almost certainly impact on FAS payments, although this has yet to be confirmed.

Links to the full judgement, summaries and discussions of the implication may be found on our Documents page.

* * * * * * * * * * * * * * *

Judicial review on Hampshire judgement starts

18 May 2020

Following the judgement in the Hampshire case described below (6 September 2018) a group of PPF members challenged the government with a judicial review of the way in which the PPF were implementing that judgement. The hearing was delayed pending the result of the Bauer case (see 19 December 2019) but has now finally begun. The judgement is expected within two months.

* * * * * * * * * * * * * * *

CJEU confirms 50% minimum compensation

19 December 2019

In a long-awaited judgement, the Court of Justice of the European Union ruled today that there is no obligation on EU governments to compensate workers who have lost their workplace pensions (broadly, members of the FAS and PPF schemes) beyond the 50% level which has already been established in previous judgments, unless that would take an individual member below the poverty line. The exact definition of the poverty line is given as "below the at-risk-of-poverty threshold determined by Eurostat for the Member State concerned". The court also reaffirmed that the 50% minimum applied to each individual person and in each individual year, not to the average compensation. The full judgement is available here and supporting documents and summaries are listed on our documents page as the 'Bauer' case.

This is a disappointment to us, as the initial opinion of the Advocate General suggested that those affected should receive 100% of their expected pension. There was some excitement in the press today that the judges had agreed, but this proved to be the result of a mistranslation from the original text in German, leading to some red faces.

* * * * * * * * * * * * * * *

ASW steelworkers in the news

30 November 2019

A group of Welsh PAG members who used to work for the steel company ASW in Cardiff have been featured in an article in Wales Online. They congratulated the women affected by the change in pension age (WASPI) for their success in getting Labour to make a commitment to overturn their injustice, but urged Labour to also consider the ongoing injustice that FAS and PPF members are facing because of the loss of their own pensions. You can read the full article at Wales Online.

* * * * * * * * * * * * * * *

Pensions survey and FAS

20 November 2019

The magazine Professional Pensions runs a weekly survey of its readers on topical issues, called Pensions Buzz. In the survey on 20 November, they asked: 'Should FAS and PPF provide indexation for pre-1997 pensionable service?'. The responses were balanced, with 36% saying that they should and 36% saying not. You can read PAG's analysis of the detailed results here.

* * * * * * * * * * * * * * *

PAG press release for the general election

4 November 2019

As we enter the general election period, around 60 MPs have announced that they will retire, of whom 13 have been in Parliament since before 1997. The inflation protection on this pre-1997 service is fully protected. This is not the case with FAS members, even if their original schemes provided for it and they had paid for it. Ironically, FAS members will still have to pay for the MPs inflation-proofing from their own depleted pensions through taxation. We do not begrudge these MPs the pensions that they worked and paid for, but we would ask all candidates to recognise the injustice and to support necessary reforms when the new parliament convenes. Full press release available here

* * * * * * * * * * * * * * *

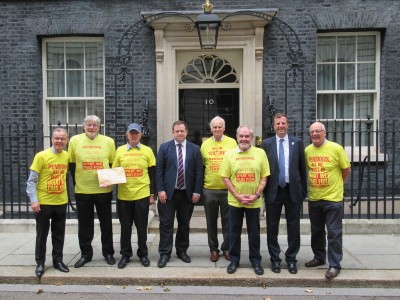

Visit to 10 Downing St

30 September 2019

Six representative PAG members, supported by Stephen Doughty (Labour MP for Cardiff South and Penarth) and Jonathan Edwards (Plaid Cymru MP for Carmarthen East and Dinefwr) were received at 10 Downing Street this afternoon where they handed in letters from all of the main political parties in Wales, reminding the Prime Minister of the ongoing injustice that FAS members are suffering as inflation erodes the already reduced pensions they are receiving from the FAS and asking for a meeting with the Pensions Minister to make our case in more detail. You can read the letters from (in alphabetical order) Conservative, Labour, Plaid Cymru and UKIP here.

* * * * * * * * * * * * * * *

PAG write to Pensions Minister about outstanding issues

6 September 2019

6th of September was the first anniversary of the landmark Hampshire decision by the ECJ, which ruled that the minimum payments received by a member of a pension scheme covered by the FAS or PPF must be at least 50% of the value of the original pension for each individual member, and in each year of payment (see the Documents page for more information).

The PAG Organising Committee have used the anniversary to write to the Pensions Minister about the progress made by the PPF and FAS in uplifting members benefits. Although there is still some way to go, progress is being made. You can read a copy of the letter from our documents collection here.

Our greatest concern particularly for FAS is the serious damage that is being done to members pensions as a result of the lack of inflation proofing and the removal of increases on what were guaranteed minimum pensions.

The 90% figure is a distant memory with many now below 60%. However when we have raised this with Government our requests are refused, even to even meet the Minister to discuss. Instead we are told that the law changed in 1997 to make it compulsory to provide inflation protection, so the reverse logic is that it isn't necessary to pay any before that date! We have asked the DWP for the number of pension schemes that did and did not have inflation proofing prior to 1997, but they claim not to hold the information and refuse our requests to discuss

What we do know is public sector pensions do not have a pre-97 cut-off and it is our taxes that pay for their increases, from our rapidly reducing FAS pensions

What are we doing?

- Writing to Guy Opperman (Pensions Minister)

- Handing in the letter to number 10 (whoever might be resident at the time!)

- Writing to a selective number of members of parliament for their support

- Seeking some press coverage

* * * * * * * * * * * * * * *

PPF update on increased member payments

2 September 2019

The PPF has today released an update on the increased payments which they are making to some PPF and FAS members as a result of the judgment in the Hampshire case at the European Court of Justice last year. They have begun additional payments to those members whose benefits have fallen below 50% of their promised pension as a result of the cap. They will now be working towards assessing members who may have fallen below 50% as a result of the combined effect of the cap and other factors, such as indexation and spouse benefits. No back payments are being made at this stage because of ongoing legal action which may affect the way in which payment increases are being calculated. The full text is available here.

* * * * * * * * * * * * * * *

PAG meeting with PPF

15 July 2019

A meeting of the PAG Notch Management Committee was held in Southoe (Cambridgeshire) today which was attended in part by two executives from the PPF who gave brief presentations and then joined in a discussion on the actions which they are planning to take once they receive the judgements from the ongoing Judicial Review and the Bauer case (see earlier news items below). This is part of a consultation exercise which they are undertaking during the planning phase. The discussions were cordial and constructive and they were receptive to the various suggestions and issues which we put forward. In particular, they emphasised the importance for members of retaining the documentation they have received from their schemes and in particular the scheme booklet. We appreciate the time and effort they took to come and meet us.

* * * * * * * * * * * * * * *

"Pensions Transfers should be faster" says regulator

8 July 2019

Ten weeks should be the maximum time limit for defined benefit transfers, said industry-wide guidelines published on Monday by the Pensions Administration Standards Association.

Pensions minister Guy Opperman welcomed the guidelines, but warned that administrators must accelerate further. He told the launch: “Ten weeks is great, but be under no illusions: government, of some shape and format, will want you to go faster in the future."

Mr Opperman said he wanted the pensions industry to be more like other UK industries – such as banking, electricity or telecommunications – in embracing simplicity and flexibility for the consumer.

“The idea that this is just too complicated for us to do any quicker... is not acceptable on a long-term basis. So I welcome where you are, but trust me you will be required to go faster at some stage.”

We are encouraged by the Ministers comments and hope that the same approach applies when resolving the PPF/FAS payments following the “Hampshire” case. We are assured interim top up payments will continue pending the Judicial Review and the “Baeur” case but need the final arrangements to be implemented as soon as possible for this rapidly aging group who have been fighting for compensation for 16 years - 80 times as long!

Full story from Pensions Expert here (requires free registration).

* * * * * * * * * * * * * * *

PPF response to JR delay

13th June 2019

The Pension Protection Fund have released an update describing their response to the delay in the Hampshire Judicial Review judgement. They plan to continue to assess and process increases to those capped members likely to be most significantly affected by the Hampshire judgment, but will not pay arrears until they have the court's decision. This is because they believe it would be wrong to risk having to recover overpayments if the court decides they must take a different approach. We will add a link to the full announcement when it appears on the PPF website.

* * * * * * * * * * * * * * *

Hampshire Judicial Review judgement postponed

8th May 2019

Judgement on the Hughes judicial review had been expected in July this year but this has now been deferred following a surprise development in a case at the Court of Justice of the European Union (CJEU). In EU case law to date, the level of compensation for people who have lost all or part of their pension through insolvency of their employer has been set at a minimum of at least 50% but there has no judgement as to whether the minimum should in fact be higher than this. In the Bauer case, Advocate General Hogan has provided advice to the court that the level should now be formally established. He states that:

"For all of these reasons, therefore, I consider that Article 8 imposes an obligation on Member States to protect all of the old-age benefits affected by an employer’s insolvency and not just part or a designated percentage of these benefits." (AG's emphasis).

He goes on to say:

"If the Union legislature had wished to dilute the extent of the obligation of Member States to protect pensioners ... in this potentially far-reaching manner, then I consider that very clear language to this effect would have been used.".

He recommends:

"a full re-appraisal of the case-law to date",

says that:

"there is no special magic in the 50%",

and recommends that:

"the reasoning of the Court in [the past] cannot be supported and should not now be followed".

The court is not obliged to follow the advice of the AG, but often does. More information can be found on our Documents page.

* * * * * * * * * * * * * * *

Judicial Review Papers registered with the High Court

11th March 2019

On behalf of some Paul Hughes and other PPF members and following the ECJ decision in September 2018, papers have now been submitted to the High Court for Judicial Review in order to clarify how the PPF (and we hope FAS) should interpret the ECJ decision and pay the correct backdated benefits to members.

* * * * * * * * * * * * * * *

New information of PPF actions following ECJ judgement

14 February 2019

According to their website, the PPF is being challenged in court over their proposed method of calculating the increases due to some members following the decision of the CJEU (see below) and they have now posted a document which describes their response, which you can find here. They have also provided more information in the form of a series of questions and answers here.

* * * * * * * * * * * * * * *

Welsh Assembly unanimous support for ASW workers

23 January 2019

In a motion proposed today by Bethan Sayed (Plaid Cymru), the Welsh Assemby unanimously called on the governement to review the terms of the FAS and PPF schemes in respect of the former Allied Steel and Wire employees, particularly in respect to the lack of pre-1997 indexation and the restriction to 90%. The detailed motion is available here and you can watch the debate here. Thank you to all of the Welsh Assembly members who supported our campaign - we really appreciate it!

* * * * * * * * * * * * * * *

Andrew Parr R.I.P

22 January 2019

It is with great sadness that we report the death of one of the key founding members and leaders of the Pensions Action Group, and much-loved friend, Andrew Parr. Our full obituary appears here.

* * * * * * * * * * * * * * *

Update on PPF/ECJ Progress

21 December 2018

The PPF have continued to work on their methodology for implementing the ECJ decision (see below), including how they will handle any missing data, and future inflation and mortality assumptions. The full article is on the PPF website here.

* * * * * * * * * * * * * * *

Details of PPF Plan to Implement ECJ Decision

5 November 2018

The PPF have now released a more detailed plan of how they intend to implement the ECJ decision (see below), including examples. Full details are available from the PPF here.

* * * * * * * * * * * * * * *

Further PPF Response to ECJ decision

15 October 2018

The Pension Protection Fund (who administer both the PPF and FAS schemes) have given further details on the approach that they intend to take in meeting the new requirements arising from the ECJ decision described below. In essence, they intend to value the benefits which a member would have received had his scheme not wound up (by getting an actuarial valuation of how much it would cost to provide similar benefits) and compare that with the cost of the benefits which they will receive from the PPF or FAS under current rules, using the same methodology. If the FAS/PPF value is less than half of the scheme value, they will increase the payments until the value is equal to half of the scheme value (ignoring the cap). In this way they intend to comply with the judgement without having to redesign their benefits framework. The main side-effect will be for the payments to qualifying members to be front-loaded because the PPF/FAS indexation is likely to be less generous than the scheme, and so higher initial payments will be needed to offset this.

The full statement is available on the PPF website here.

* * * * * * * * * * * * * * *

Important Decision at the European Court of Justice

6 September 2018

The case before the European Court of Justice referred to below has now been decided and the full judgement released today. The judges have ruled in two important areas:

- where a company pension fund is wound up in deficit and the scheme is eligible for the FAS or PPF, each individual member must receive at least 50% of his promised benefits in each year of retirement; and

- individual members may take action against the government if this does not happen.

At present, the members most likely to benefit immediately are those who are affected by the cap. However, the ECJ made clear that by 'benefits' they meant all benefits allocated to the member, including indexation and survivor pension, rather than just the core benefits which the FAS and PPF currently take into account. Thus those people who had many years of service prior to 1997 or had indexation provisions greater than the legal minimum will be provided with some protection against inflation. In particular, the following provisions must now be included, where they were specified in the original scheme rules:

- indexation in respect of service prior to 1997

- indexation at a rate greater than 2%

- minimum indexation levels

- use of RPI rather than CPI

These provisions will not kick in until the level of payments is reduced to below 50% of the promised pension but should then be applied so that the payments do not fall further.

This is a stunning success and we offer our congratulations to the brave plaintiff who was prepared to risk so much in taking on the UK government in the highest courts.

The full judgement may be seen here, there is a description of its provisions here and the initial PPF response is on their website here.

* * * * * * * * * * * * * * *

Developments at the European Court of Justice

28 April 2018

In a case being heard before the European Court of Justice, the Advocate General last week published an Opinion (a statement given in advance of a later court judgement) which is supportive of the plaintiff, who is someone currently receiving substantially less from the PPF than his total expected pension. If this Opinion is adopted in the final verdict to be announced later this summer it could possibly result in increased payments for the plaintiff and some other members receiving the PPF (and, potentially by extension, the FAS). This is because the Advocate General in her Opinion believes that each individual member has rights to a certain level of payment, based on all his or her pension benefits rather than just the 'core' pension currently used in calculations by the DWP and PPF. In this case the plaintiff is hit by both the cap and the loss of his full expected inflation provisions, including pre-1997 indexation.

The full opinion can be found here and a legal interpretation here.

We watch this case with interest, and will assess the impact and any action needed to be taken if the eventual Court verdict is in favour of the PPF member.

* * * * * * * * * * * * * * *

FAS admin to be taken in-house by PPF

18 April 2018

If you are a member of the Financial Assistance Scheme (FAS) then you should shortly be receiving a letter from the Pension Protection Fund (PPF), who administer the FAS, to notify you that they plan to stop out-sourcing the FAS administration and to bring it in-house by Autumn 2018, using their own staff. This is good news for FAS members, because the PPF office is run efficiently and they did the same thing, successfully, with the PPF administration services in 2015. PAG has always had good relationships with the PPF organisation and we believe that this change will work to the benefit of our members.

* * * * * * * * * * * * * * *

Statement of Opinion tabled in Welsh Assembly

8 February 2018

A new Statement of Opinion has been tabled by Bethan Jenkins (Plaid Cymru) in the National Assembly of Wales (OPIN-2018-0073) titled "Guaranteed pensions for former Allied Steel and Wire workers". The text of the opinion reads:

This Assembly:

- Acknowledges the promise the UK Government made to the Allied Steel and Wire steelworkers to guarantee compensation for the pensions taken from them at the time their firm went under.

- Recognises that in decades of work, the workers paid for 100 per cent of their pensions, but that in 2007 they agreed to accept only 90 per cent.

- Further acknowledges that inflation since 2007 will have wiped out 25 per cent of the value of a pension issued in 2007.

- Is concerned that the UK Government has now refused to grant the ASW pensioners inflation-protected pensions.

You can track the progress of the SOP here (external link).

Thank you to Bethan and all AMs who are supporting this initiative.

* * * * * * * * * * * * * * *

Early Day Motion launched in Parliamnent

8 February 2018

MP Jonathan Edwards has sponsored a new Early Day Motion (number 927) in the House of Commons in support of ASW workers who lost their pensions and, by implication, all workers who are covered by the FAS and PPF schemes. It reads:

"That this House: notes the promise made to the ASW steelworkers to guarantee compensation for pensions that were lost at the time their firm went bust;

Recognises that in decades of work they paid for 100 per cent of their pensions;

Further notes that in 2007, those workers agreed to accept only 90 per cent of their pension;

Further recognises that the Government guaranteed that it would deliver to those workers 90 per cent of the pension for which they paid;

Acknowledges that inflation since 2007 will have wiped out 25 per cent of the value of a pension issued in 2007;

Is concerned that the Government has now refused to grant the ASW pensions inflation protected pensions, thereby breaching the guarantee of 90 per cent of a pension, the whole of which should have been theirs in the first place."

The EDM is also sponsored by MPs Liz Saville Roberts, Hywel Williams, Ben Lake, Jim Cunningham and Kelvin Hopkins. Please encourage your MP to sign it in support, even if you were not an ASW employee. You can keep track of the number of signatures here (external link).

* * * * * * * * * * * * * * *

Older news items, going back to the start of our campaign in 2002, together with a link to our newsletter archive, can be found here

|